Calculate Your Property Taxes

Estimated Annual Property Tax

Understanding Arkansas Property Taxes

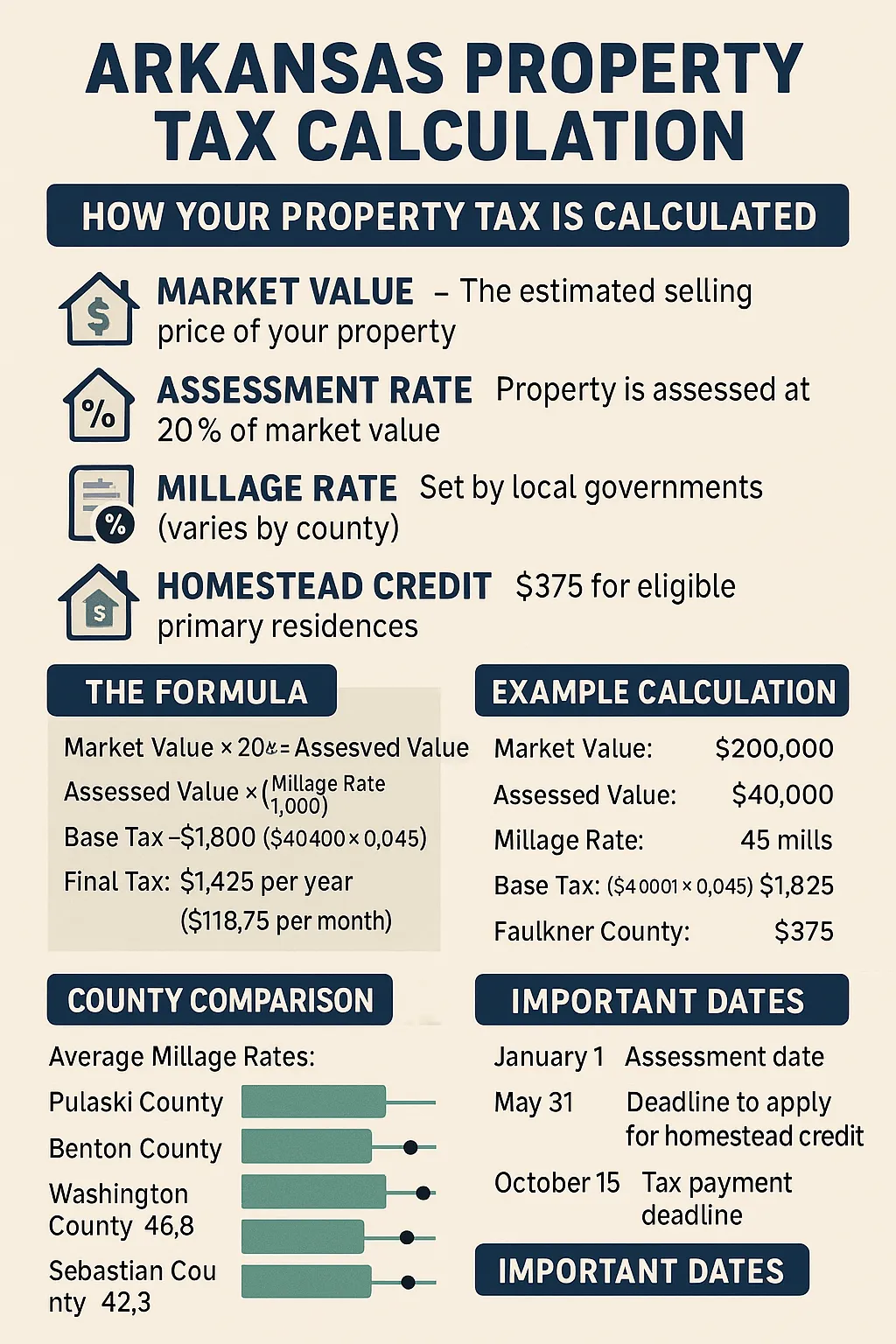

Property taxes in Arkansas are based on the assessed value of your property, which is 20% of the market value. The tax amount is calculated by multiplying the assessed value by your local millage rate, which varies by county and school district.

How Are Property Taxes Calculated?

The formula is simple: (Market Value × 20%) × (Millage Rate ÷ 1,000) = Annual Property Tax

Arkansas property owners may also be eligible for a $375 Homestead Credit if the property is their primary residence.

Frequently Asked Questions

Need More Property Tax Information?

Contact your local county assessor's office for specific information about your county property taxes Arkansas and available exemptions.

Arkansas Property Tax Visual Guide

This infographic explains the Arkansas property tax system, calculation methods, and important dates to remember.

Click on the infographic to view in full size

Understanding Arkansas Property Taxes

Property taxes in Arkansas can vary by county, but the basic calculation method and related processes follow a consistent structure statewide. Below are key points to help you understand how it works:

- How Taxes Are Calculated: Arkansas assesses property at 20% of its market value. This assessed value is then multiplied by your county's millage rate to determine your annual property tax bill.

- What Is a Millage Rate? A mill is one-tenth of a cent. In property tax terms, a millage rate is the amount per $1,000 of assessed value. For example, a rate of 45 mills means $45 in taxes for every $1,000 of assessed value.

- County-by-County Tax Breakdown: Millage rates and exemptions vary by county. Check with your local Assessor’s and Collector’s offices for accurate, up-to-date numbers in your area.

- FAQs:

- When are property taxes due in Arkansas? Typically due by October 15 each year.

- Can I pay online? Yes, most counties accept online payments through their Collector’s Office website or the Arkansas.gov tax portal.

- 2025 Updates: As of now, many counties have published updated millage rates for 2025. Always verify the latest rates with your County Assessor or the Arkansas Assessment Coordination Division.